Last time in off-topic tax time we covered a small piece of how individual income taxes work in the US. This time, I’ll vent about why this is frustrating and why the alternatives are not great. It’s a positive feelings post.

Recap

Recapping the last post, marginal tax rates are different from effective tax rates. The effective tax rate is what we actually pay and is affected by deductions and credits. Aside from the ‘standard deduction’, almost all deductions and credits have rules for who can use them to reduce their taxes.

My chief frustrations with credits and deductions are,

- Required to be identified by the filer. That is, you have to know about them, claim them, and prove eligibility

- Unevenly distributed. A small example of uneven distribution is found in the treatment of dependent care credit and earned income credit. Both include provisions to help families with children pay for their expenses by reducing tax burden, but only one of these, the earned income credit, is refundable. In other words, the dependent care credit does not help the lowest income level of taxpayers because they might not owe enough taxes to take advantage of the credit in the first place.

- Sometimes inscrutable rules for when credits and deductions can be taken and how much can be taken. The earned income tax credit is an example of this which uses a set of interacting rules to determine applicability based on the taxpayers age, marital status, dependent status, and income level.

Possible fixes

Caution ahead, I’m neither a public policy nor tax law expert. The following are informed by my life and experience.

Eliminate them and implement a ‘flat tax’

Flat taxes or, regressive taxes, while seemingly appealing, burden low income payers more than high income payers in absolute terms. An illustrative example,

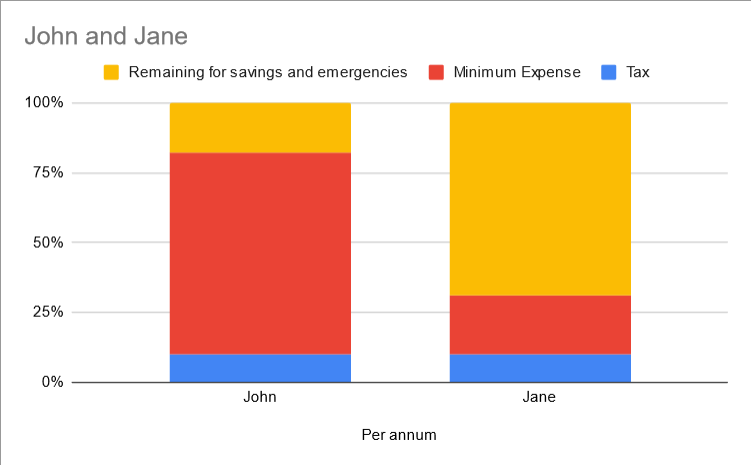

- A flat income tax of 10%

- John makes $25000/yr and owes $2500 in income tax, leaving $22500/yr for other expenses

- Jane makes $85000/yr and owes $8500 in income tax, leaving $77500/yr for other expenses

- John and Jane both live in Someplace, USA where the minimum cost to live is $1500/mo or $18000/yr for basic necessities like rent, food, etc.

John spends a greater share of his net-of-tax income on basic necessities (80% to be exact) versus Jane who spends ~23%.

Increasing the flat taxes percentage exacerbates how little income John has left over to save, handle emergencies, etc.

There is a philosophical debate about what ‘fairness’ means in this space that I’m not going to address. For me personally, flat taxes are the wrong tool because living expenses beyond a certain point don’t scale (down) with income and, as a result, those in lower income brackets are disproportionately burdened by them.

Eliminating federal incentives for behaviors and wealth transfers

Like flat taxes, there is an initially appealing surface level of fairness to simply eliminating targeted deductions and credits. The challenge is that many of the most common deductions and credits are designed to benefit things we, as a country, value. The earned income tax credit is very generous to lower income families with children. Ignoring tax terminology, the EITC is a wealth transfer from higher income individuals to lower income individuals and is a small government subsidy for having children. Other niche credits and deductions incentivize things like improving real property with energy efficient equipment or provide reimbursements for moving expenses.

Eliminating all existing credits and deductions while keeping progressive income taxes would raise everyone’s tax effective due to the elimination of the standard deduction. This is likely untenable for those in lower income brackets and would mean implementation of this idea would require modification of the tax rate brackets described in the original post. For example, instead the amount of income free of all income tax would likely need to increase significantly.

Incidentally, the 2017 ‘Tax Cuts and Jobs Act’ did a half-baked version of this by eliminating some deductions and increasing the standard deduction so much that it no longer made sense to take other targeted deductions. Unfortunately, this approach also does not work well since many deductions are still present, as are many credits, leaving significant complexity in the tax code. Additionally, the act as passed in 2017 sunsets in 2025 without an act of congress, reverting us to the pre-2017 tax code. Constant changes to the tax code is yet another source of complexity. There’s also a final reason to disagree with the approach taken in the 2017 law.

I will ignore the impact of standard deduction and, again, the philosophical debate about general fairness. I think it is the case that we, as a country, use public policy to incent certain behaviors. There is debate about what behaviors, but we can probably agree that it makes sense to have tools to do so. In short, eliminating wealth transfer is probably not the path to a simpler to use tax code.

Move transfers and behavioral incentives out of the tax code to a separate administrative entity

There is some precedent for this, programs like SNAP and Section 8 Housing vouchers are administered outside of the IRS by the Dept. of Agriculture and Dept. of Housing and Urban Development respectively. More generically, transfers for and programs that incent behaviors like rearing children could be administered within existing federal agencies instead of as part of our tax code.

Continuing the example, we could craft responsive and targeted programs for child care by giving the Dept. of Health and Human Services (HHS) an annual budget and directive to promote healthy children and families. I am an adherent of the idea that people closer and that focus more on an issue know better how to address it than those further from it. In the context of this example, the HHS has a department whose mission literally reads, “initiatives that empower families and individuals and improve access to services in order to create strong, healthy communities…” This is as opposed to federal senators and representatives attempting to craft policy via tax code whilst not being specialists in any particular issue.

I like this approach. It gets things that are unrelated to revenue generation for the government out of the tax code and it simplifies what goes into the average tax return.

Unfortunately, it has practical challenges. Budget Reconciliation is a tool frequently used in recent years to pass federal spending bills and it limits how money can be allocated. Again, I am not a policy nor legal expert, but it seems like part of the reason for these programs to appear in the tax code is the use of reconciliation. Additionally, programs like SNAP and Section 8 Housing vouchers also have issues in terms of availability, awareness, and ease of use. Some of these are the same issues discussed earlier in the context of deductions and credit. All of these issues could likely be resolved with sufficient funding, prioritization, efficient procurement practices, and more.

Conclusions?

Public policy is really hard.

It feels like the tax code is being used as a tool to implement monetary transfers and behavioral incentives that we could better achieve by other means. There are practical reasons why we do use the tax code for things like encouraging energy efficient home renovations. But better funded agencies offering direct subsidies though (or perhaps some program structure we all have not thought of yet!) seem like a way to get a simpler to use tax code along with programs administered by those closer to the issues.

Thoughts?